Beautiful Info About How To Buy A Preferred Stock

Preferred stock often has a callable feature that allows the.

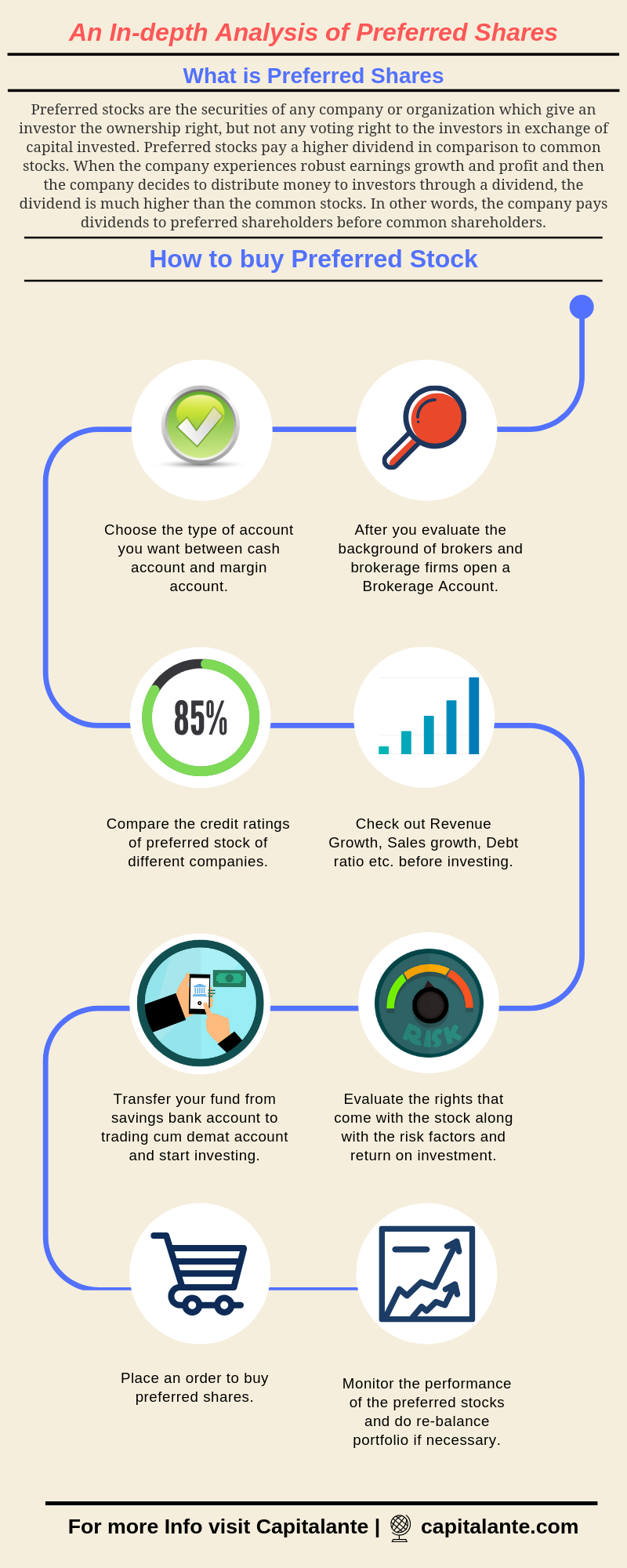

How to buy a preferred stock. Mutual fund schemes with a focus on international. Investors purchase shares at the offering price, and the company receives. There are many online investing platforms where you can create an account, fund it and simply place orders for the preferred stock you’d like to invest in.

Moneycontrol according to a report by, people give more preference to mutual funds for investing in stocks listed abroad. The preferred stocks in india are known as preference shares. (1) each series of preferred stock was issued by bank of america corporation (the corporation).

The dividends are a selling feature,. Check in on your investment. The benefit of this approach is that by owning a diversified mix of preferred shares you.

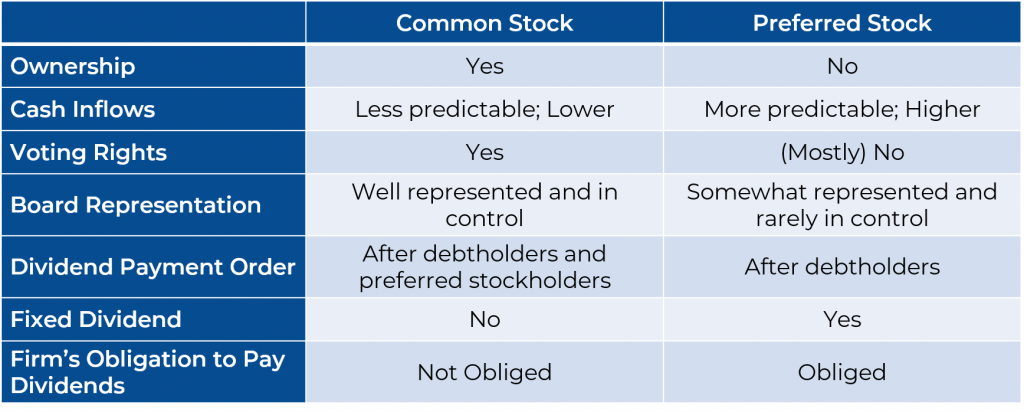

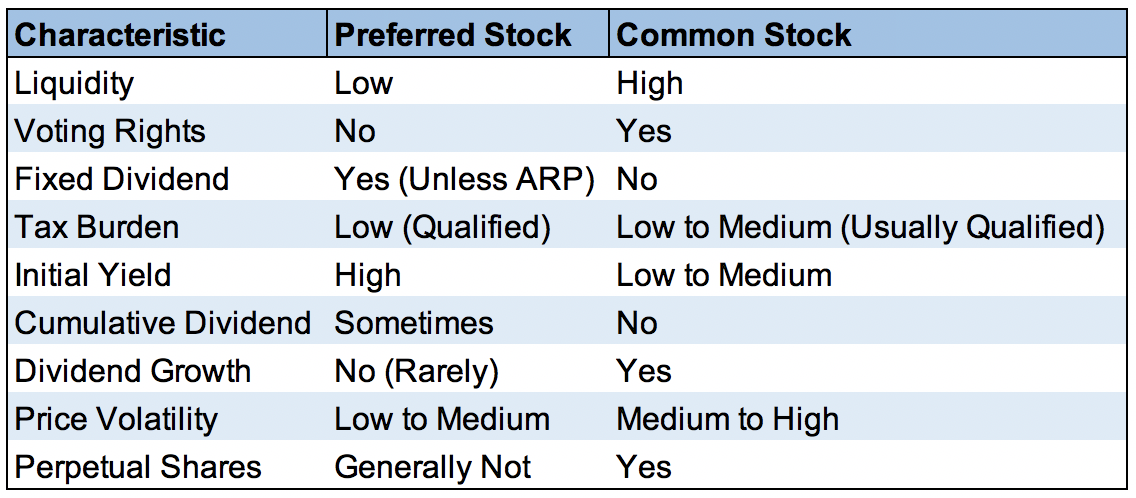

Preferred shares are so called because they give their owners a priority claim whenever a company pays dividends or distributes assets to shareholders. One way to do this is by investing in preferreds through an etf or mutual fund, which allows you to buy a collection of preferred stocks and minimize the risk associated with. The final prospectus supplement for each series, if available, is hyperlinked in.

Preferred shares are issued in a similar manner to common shares. Is buying preferred stock a good investment?. Some companies issue preferred stocks to raise cash.

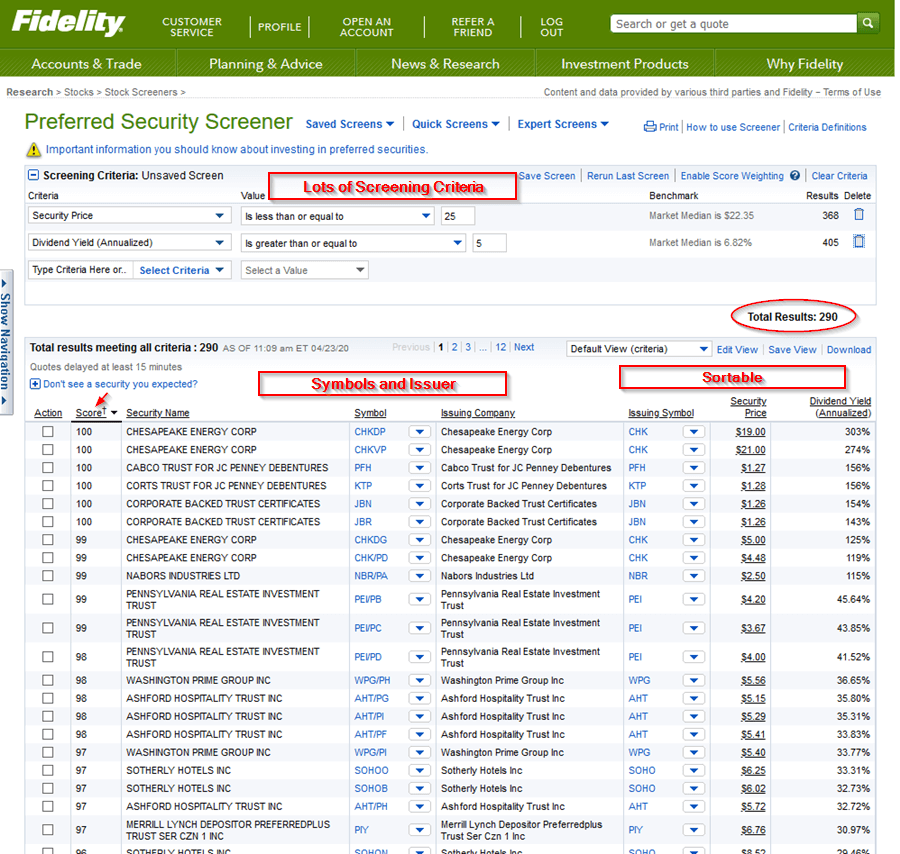

They are governed by the preference shares (regulation of dividends) act, 1960. The other way to buy preferred stock is by purchasing shares of a preferred stock mutual fund or etf. Buy your desired number of shares with a market order or use a limit order to delay your purchase until the stock reaches a desired price.

/PreferredStock-FINAL-c6dbf29d50d34121aa17f0b7ea771bad.png)

/PreferredStock-FINAL-c6dbf29d50d34121aa17f0b7ea771bad.png)