Who Else Wants Tips About How To Lower Your Credit Score

Chipping away at your revolving debt.

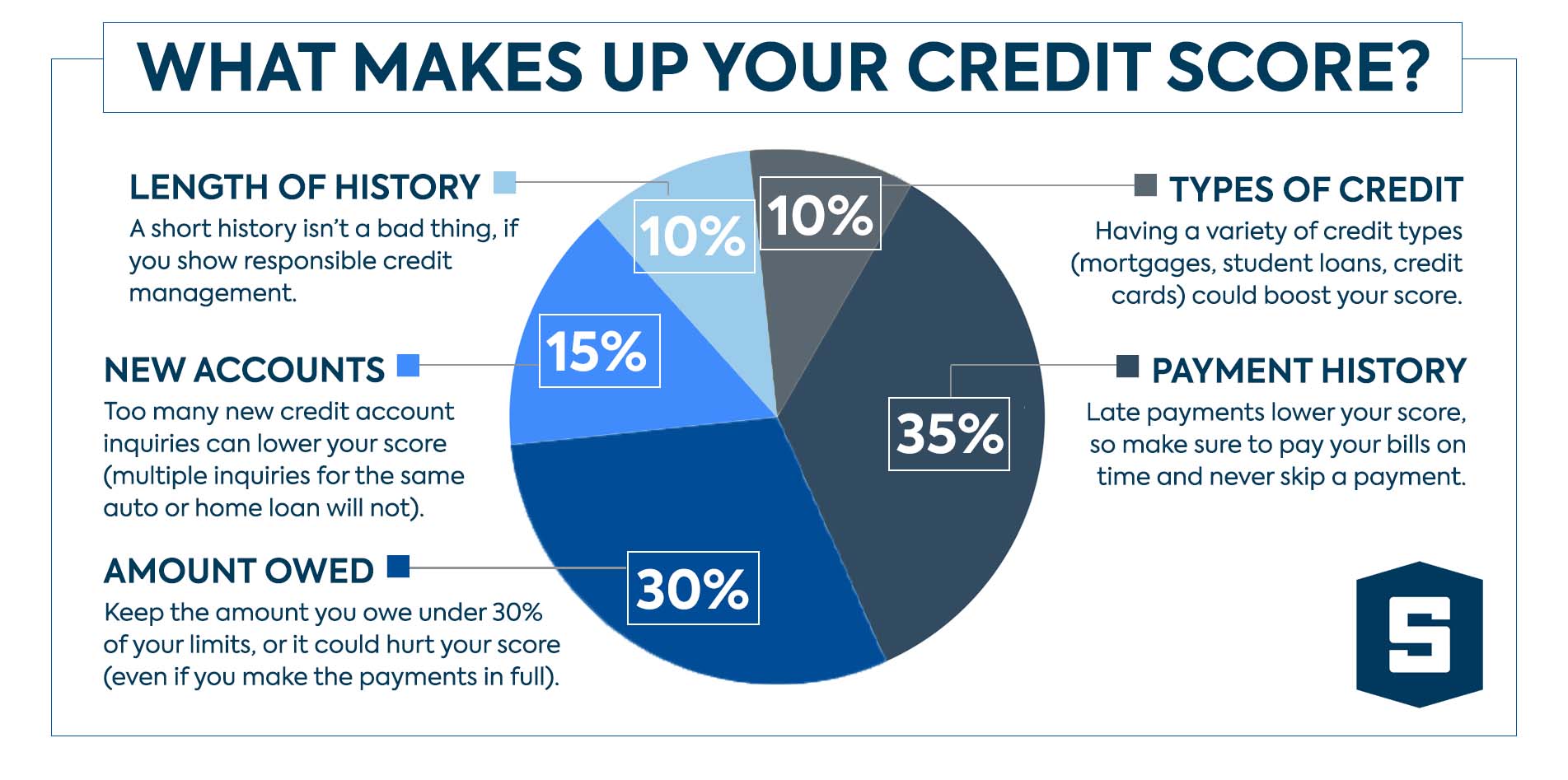

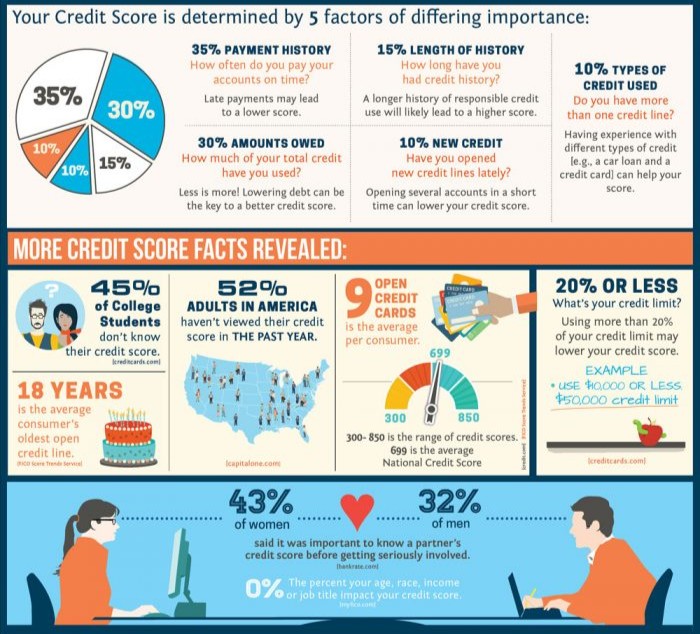

How to lower your credit score. 35% of your score comes from on time payments. Monitor your experian credit report & get alerts. Although this may seem obvious, think about it again in terms of your credit utilization ratio.

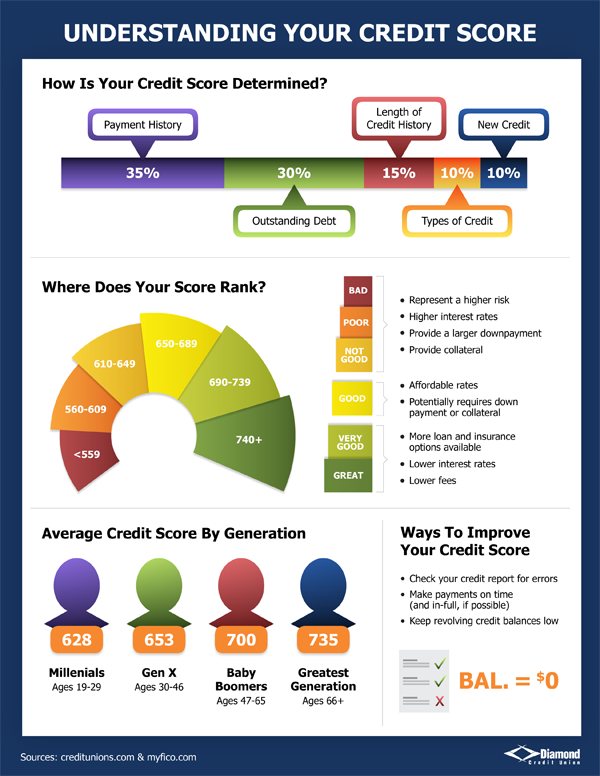

Pay your bills on time: If your score was 600, though, and you only qualified for a 6.25%. Lower your “credit utilization ratio”.

If you’ve had recent hard inquiries or have opened a new account, that indicates an increased risk to. Avoid maxing out your credit accounts. Your payment history has the largest impact on your credit score, accounting for 35% of your overall score.

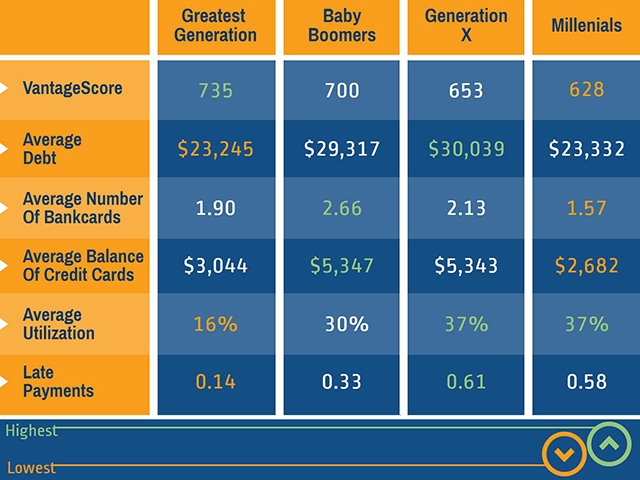

Lauren smith, wallethub staff writer. If your credit score is already at the higher end of the spectrum , any boost you see may be minimal. If your debt has increased without your.

But for people with credit scores of 680 or lower, the average increase is 19. Pay your bills on time. See score factors that show what’s positively or negatively impacting your credit score.

To raise your credit score by 5 points, you can dispute errors on your credit report, pay your bills on time and lower your credit utilization. Paying your bills on time is one of the most important steps in improving your credit score. Try to use only 30% or less of your available credit lines.

:max_bytes(150000):strip_icc()/common-things-that-improve-and-lower-credit-scores2-f5cf389fdf4f46579ddcc49d8db40525.png)

/things-that-boost-credit-score-960381-v2-9599c06fcdfd4108b67a291dabd43b7d.gif)